Home hunters are getting some aid as mortgage charges d

Home hunters are getting some aid as mortgage charges dip.

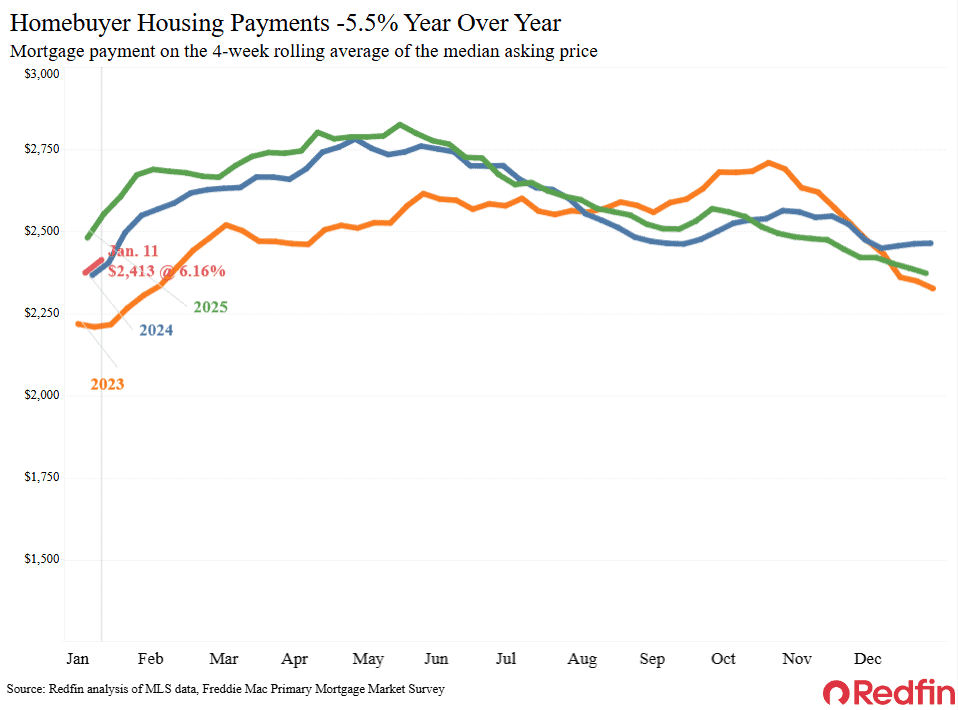

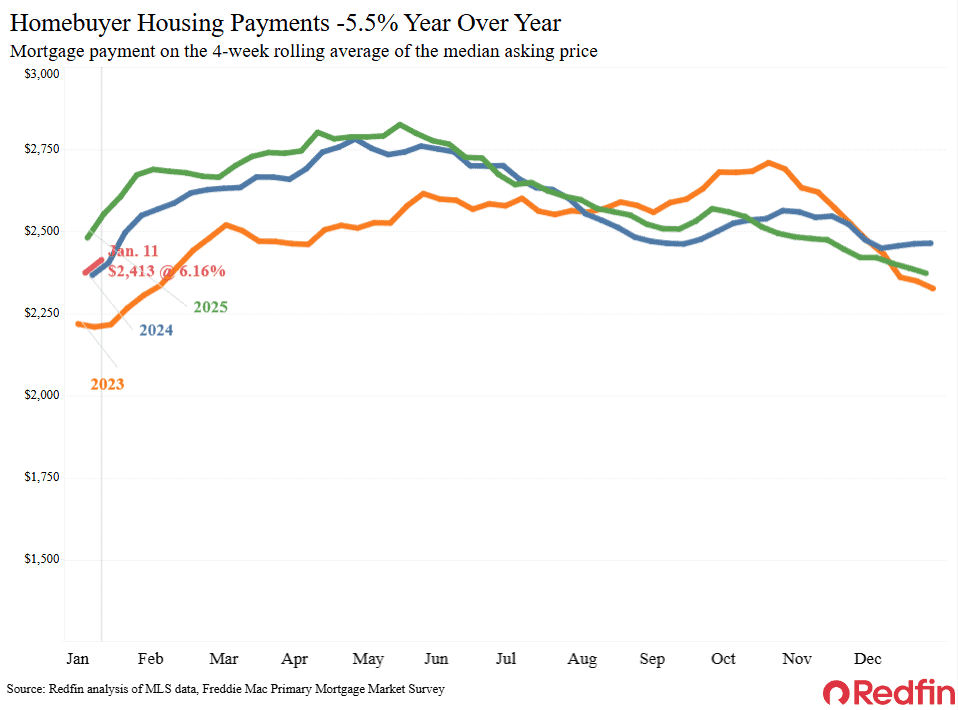

The median U.S. month-to-month housing fee dipped to $2,413 throughout the 4 weeks ending January 11, close to the bottom stage in two years and down 5.5% from a yr earlier. That’s the most important decline since October 2024.

Housing funds are coming down as a result of mortgage charges are falling. The day by day common mortgage price dropped to 5.99% final week, its lowest stage in practically three years, after President Trump ordered federal businesses to buy $200 billion in mortgage bonds (the day by day common price has since ticked as much as 6.07%). To take a look at the affect of declining mortgage charges one other approach, homebuyers’ purchasing power has increased by roughly $14,000 within the final month and $30,000 within the final six months.

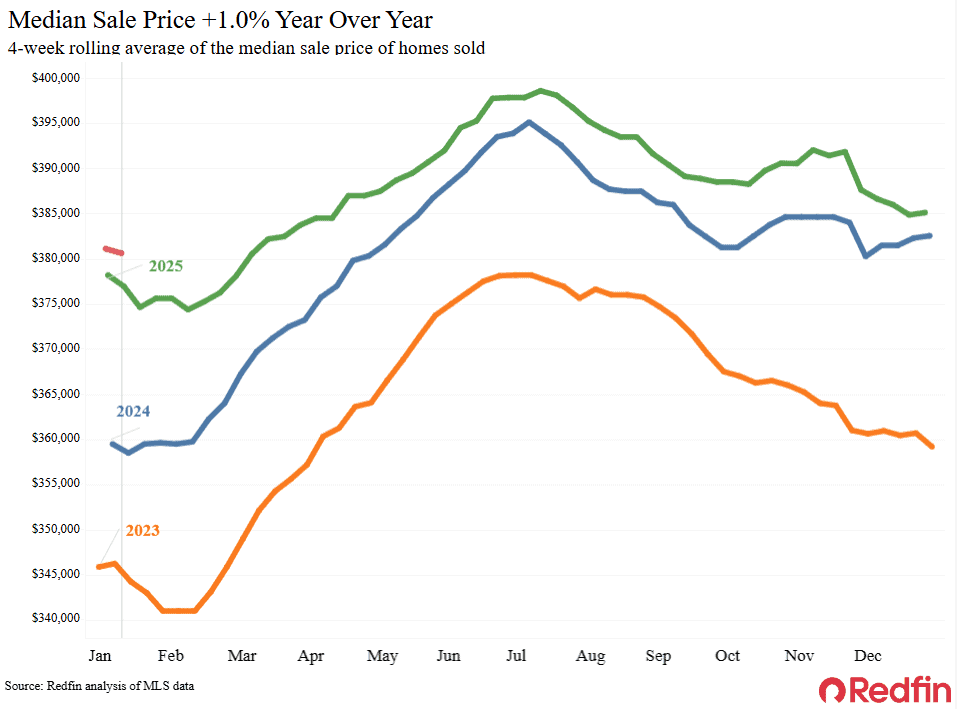

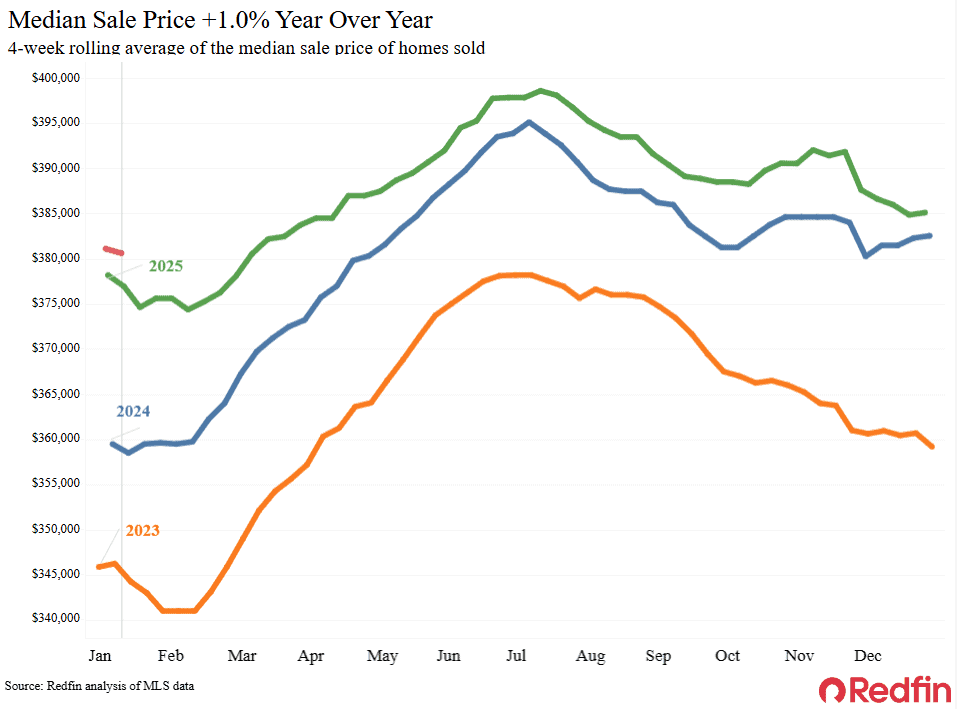

Month-to-month housing funds could be falling extra if not for still-rising sale costs. The median home-sale worth is up 1% yr over yr, although it’s price noting that’s small in comparison with the 4% to five% will increase firstly of 2025.

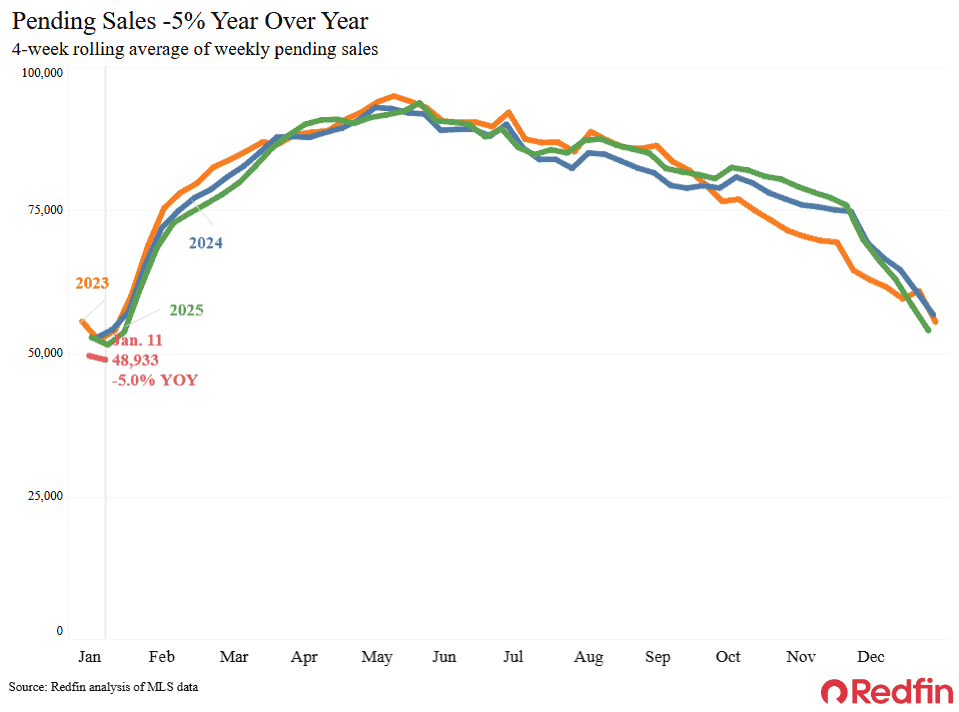

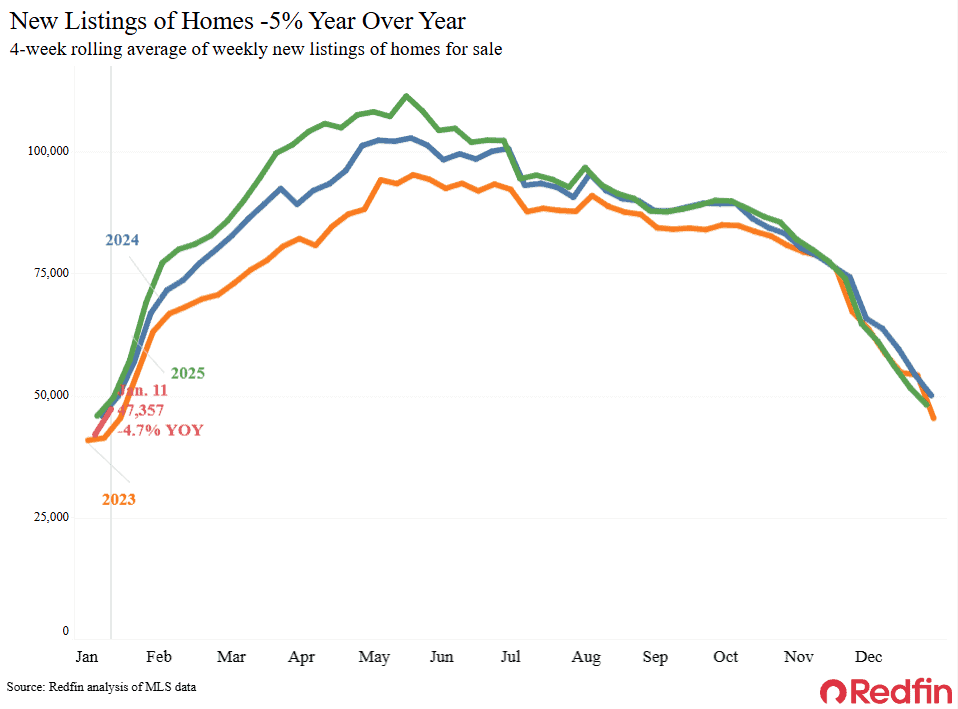

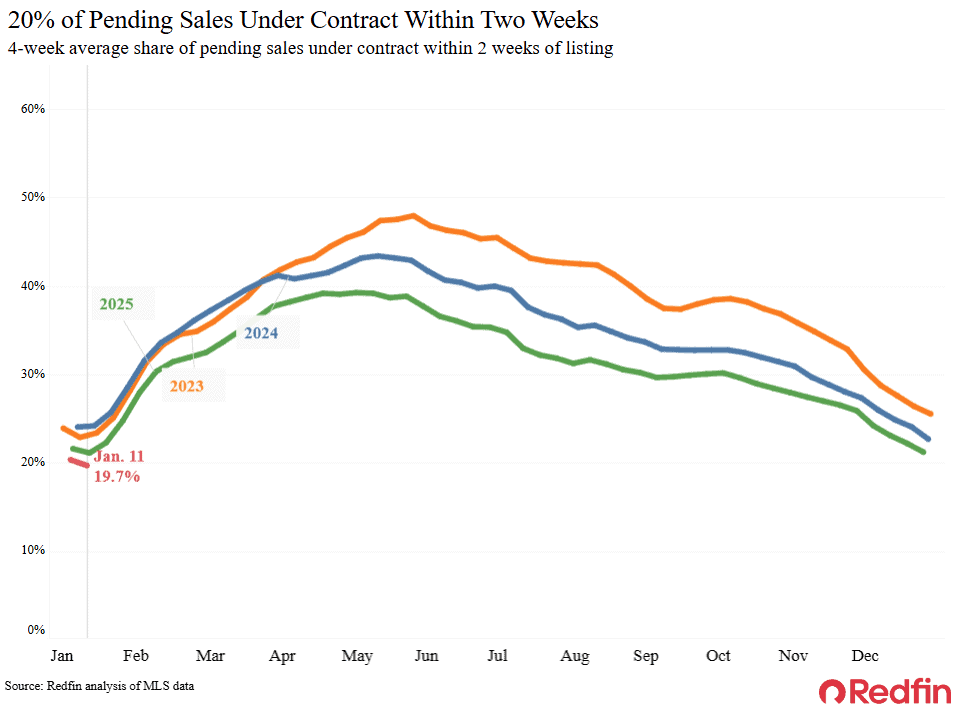

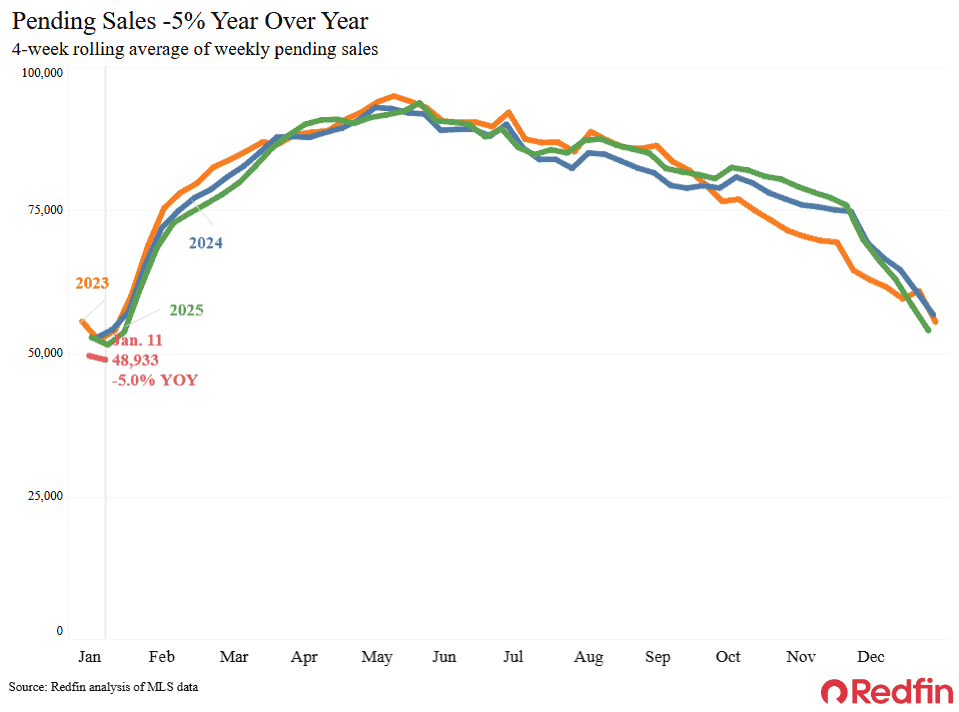

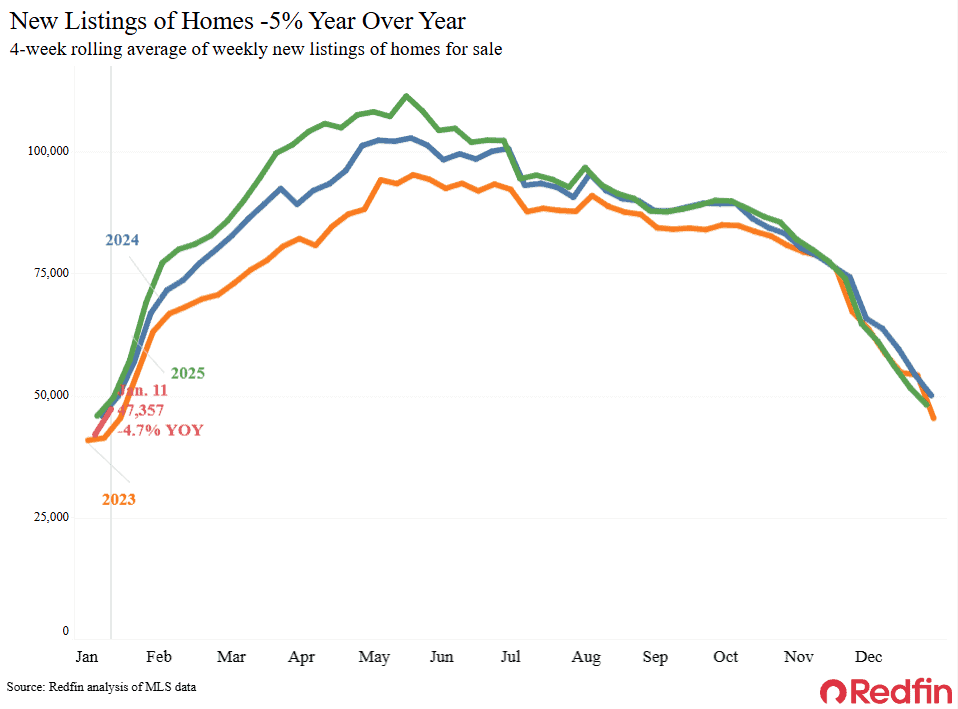

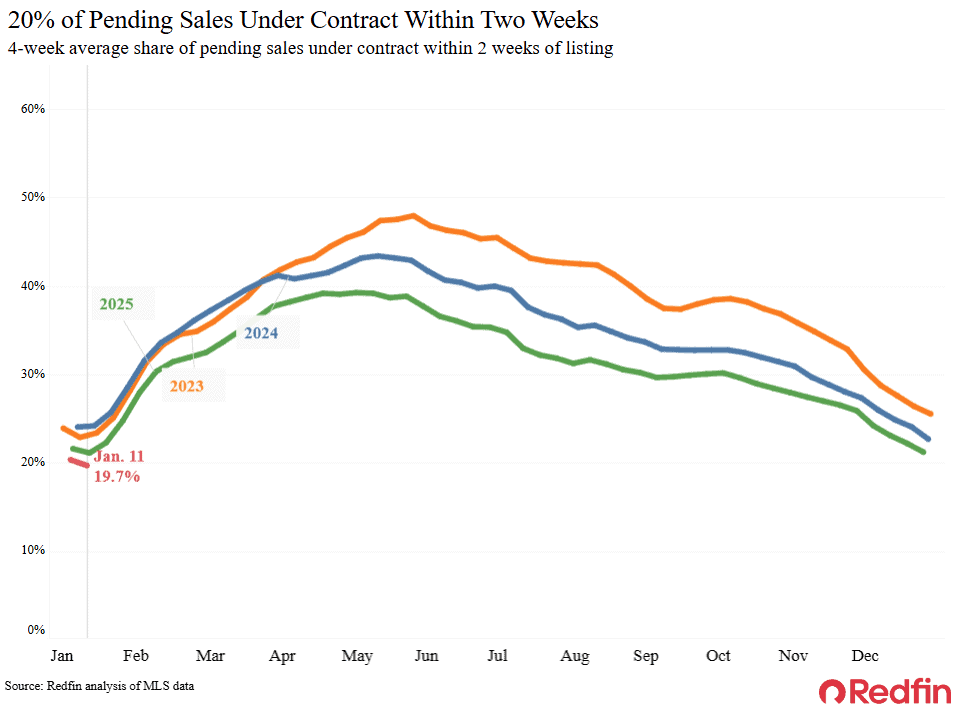

Regardless of decrease housing prices, fewer individuals are shopping for and promoting houses. Pending residence gross sales fell 5% yr over yr, and new listings declined 4.7%. We might even see an enchancment in pending gross sales quickly; final Friday’s important price decline, from roughly 6.21% to five.99%, might end in extra houses going underneath contract within the coming weeks. Mortgage-purchase purposes are up 16% week over week, although mortgage purposes don’t all the time line up with residence gross sales.

“Portland patrons usually hibernate in January, with the gloomy climate protecting them inside. However I feel this yr can be livelier,” stated Meme Logginsa Redfin Premier agent in Portland, OR. “Proper now, houses are sitting available on the market for a number of months, and loads of sellers are reducing their asking worth. Consumers know that’s unlikely to final lengthy, particularly with charges coming down. Potential patrons know competitors will most likely tick up by springtime, so that they’re getting severe about home looking and getting a deal whereas they’ll.”

For Redfin economists’ takes on the housing market, please go to Redfin’s “From Our Economists” web page.

Main indicators

| Indicators of homebuying demand and exercise | ||||

| Worth (if relevant) | Latest change | 12 months-over-year change | Supply | |

| Every day common 30-year mounted mortgage price | 6.07% (Jan. 14) | Close to lowest stage in 3 years | Down from 7.26% | Mortgage News Daily |

| Weekly common 30-year mounted mortgage price | 6.16% (week ending Jan. 8) | Close to lowest stage in over a yr | Down from 6.93% | Freddie Mac |

| Mortgage-purchase purposes (seasonally adjusted) | Up 16% from every week earlier (as of week ending Jan. 9) | Up 13% | Mortgage Bankers Association | |

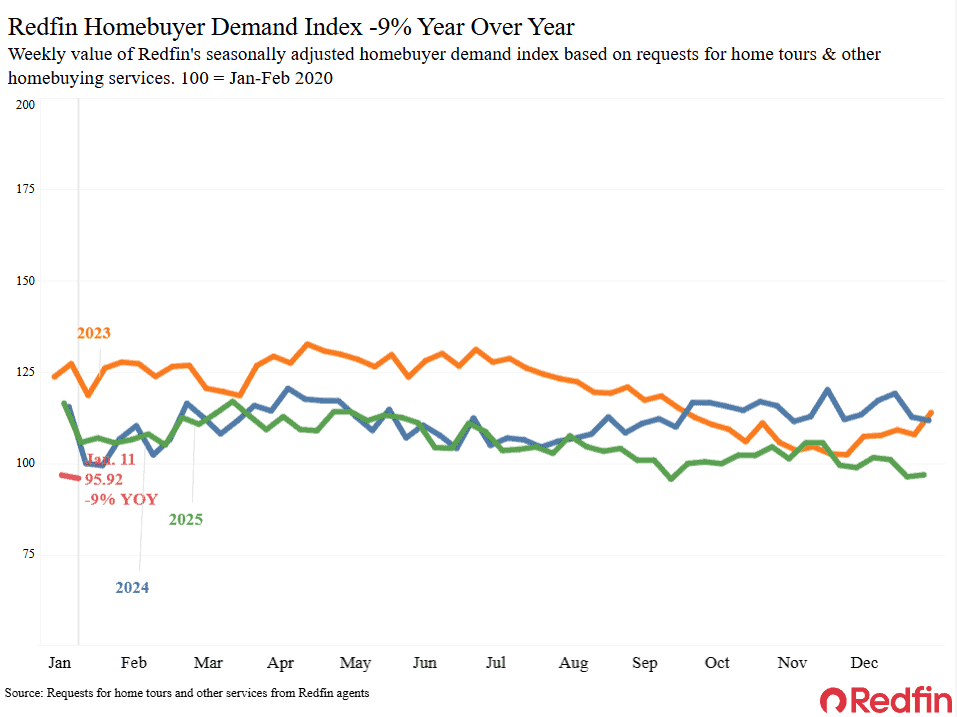

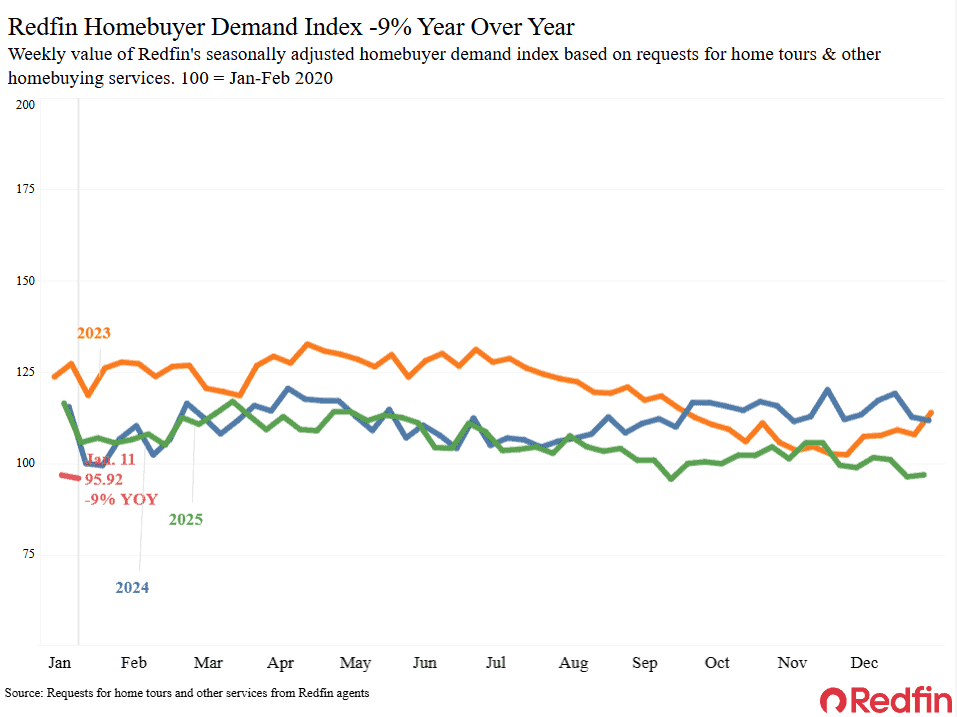

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down about 5% from a month earlier (as of week ending Jan. 11) | Down 9% | A measure of excursions and different homebuying providers from Redfin brokers | |

| Google searches of “houses on the market” | Up greater than 20% from a month earlier (as of Jan. 11) | Up 19% | Google Trends | |

Key housing-market information

| U.S. highlights: 4 weeks ending Jan. 11, 2025

Redfin’s nationwide metrics embody information from 400+ U.S. metro areas and are based mostly on houses listed and/or offered throughout the interval. Weekly housing-market information goes again by means of 2015. Topic to revision. |

|||

| 4 weeks ending Jan. 11, 2025 | 12 months-over-year change | Notes | |

| Median sale worth | $380,606 | 1% | |

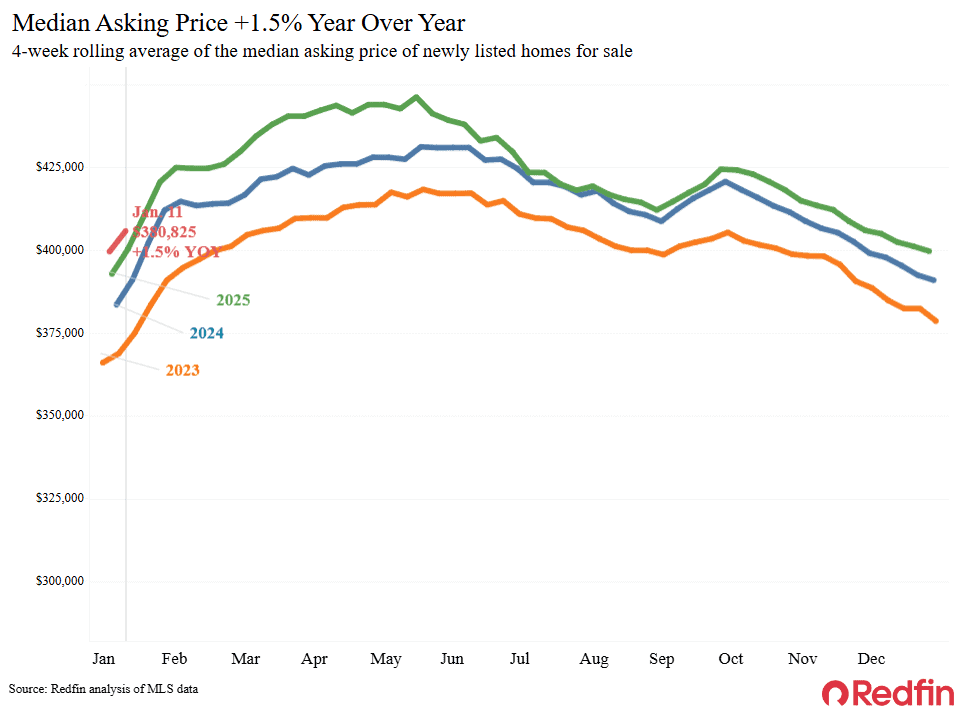

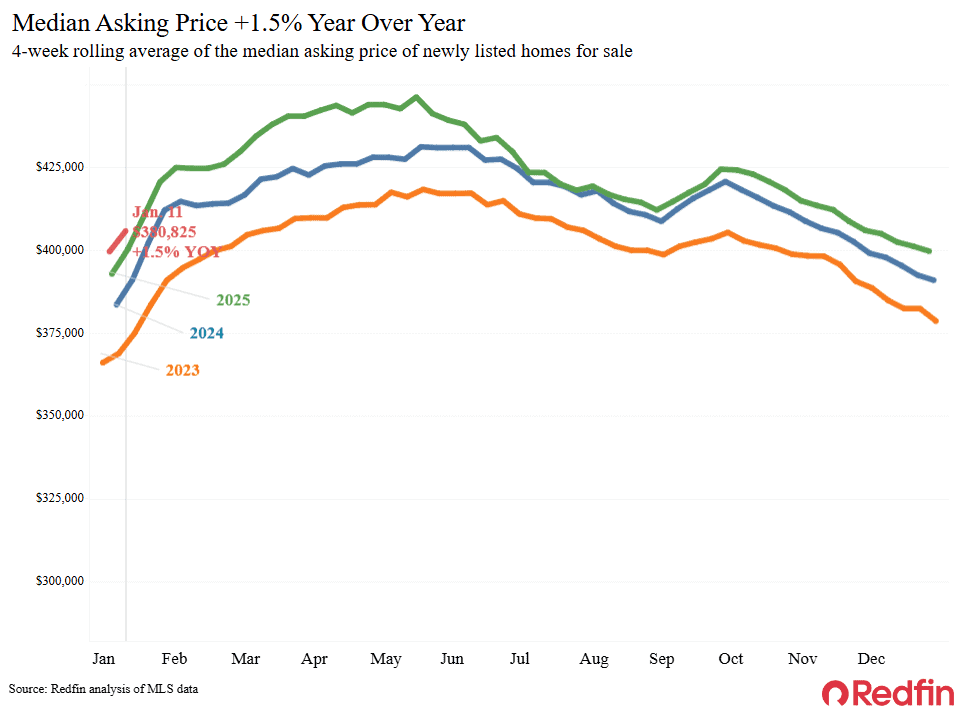

| Median asking worth | $380,825 | 1.5% | |

| Median month-to-month mortgage fee | $2,413 at a 6.16% mortgage price | -5.5% | Close to lowest stage in 2 years; largest decline since October 2024 |

| Pending gross sales | 48,933 | -5% | |

| New listings | 47,357 | -4.7% | |

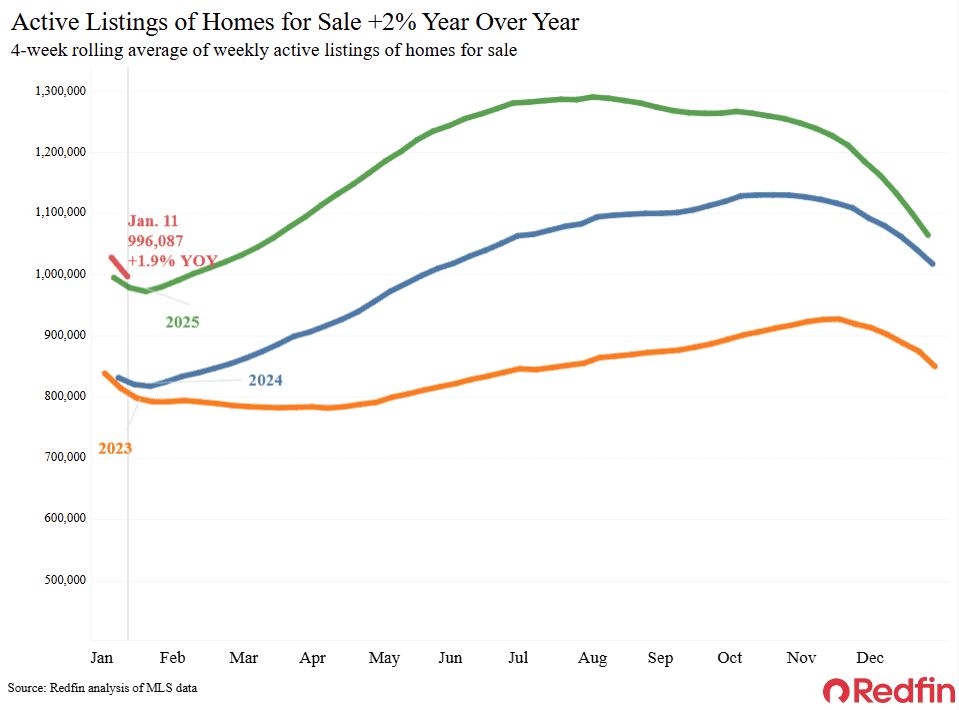

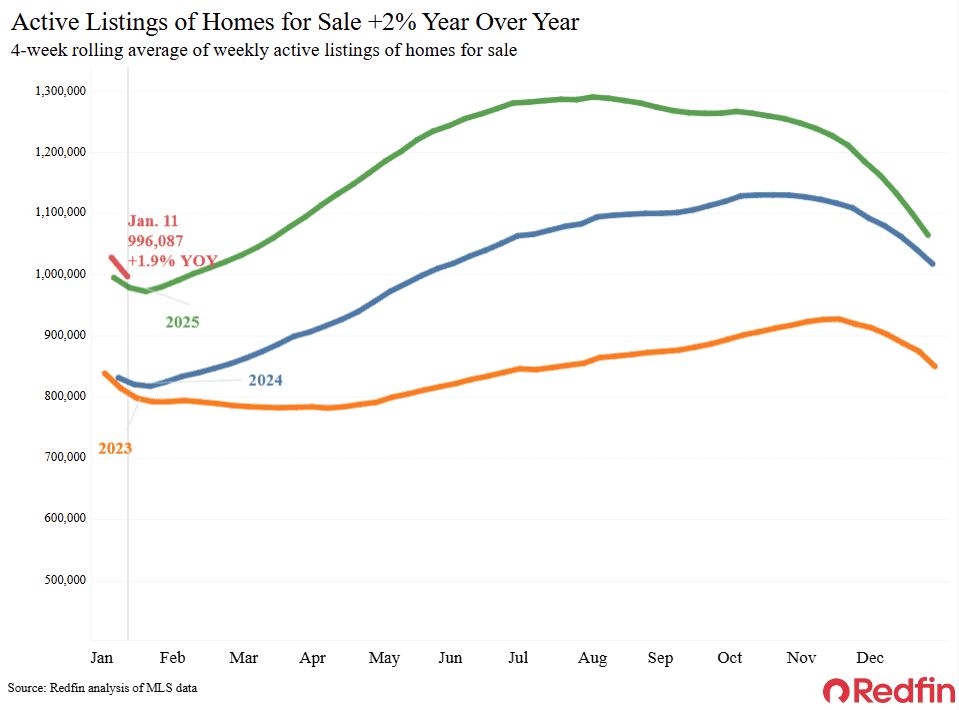

| Lively listings | 996,087 | 1.9% | Smallest improve in over 2 years |

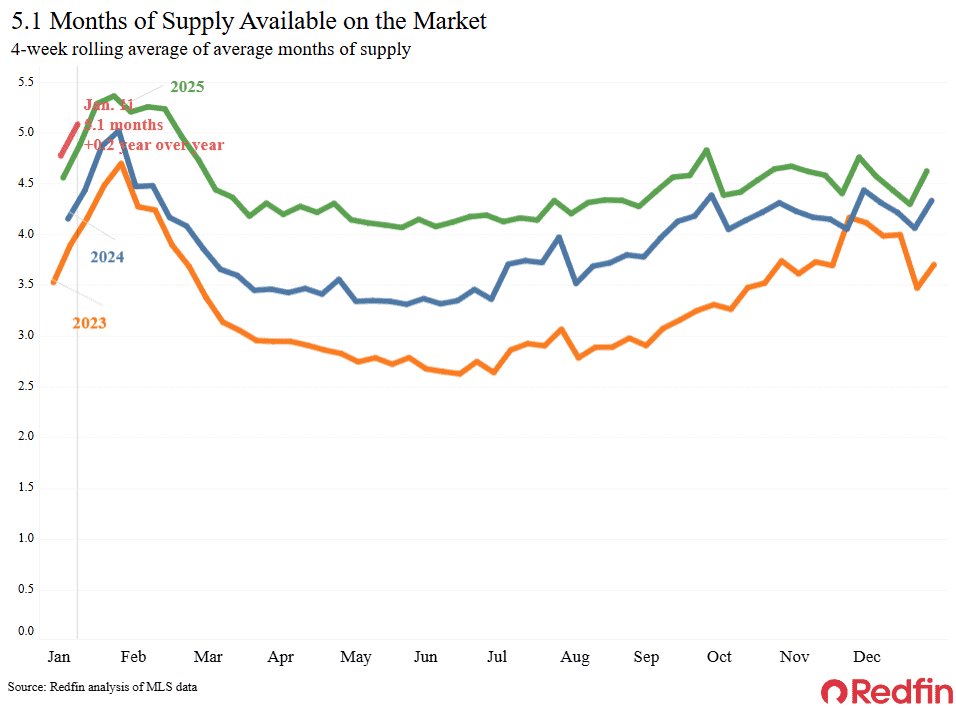

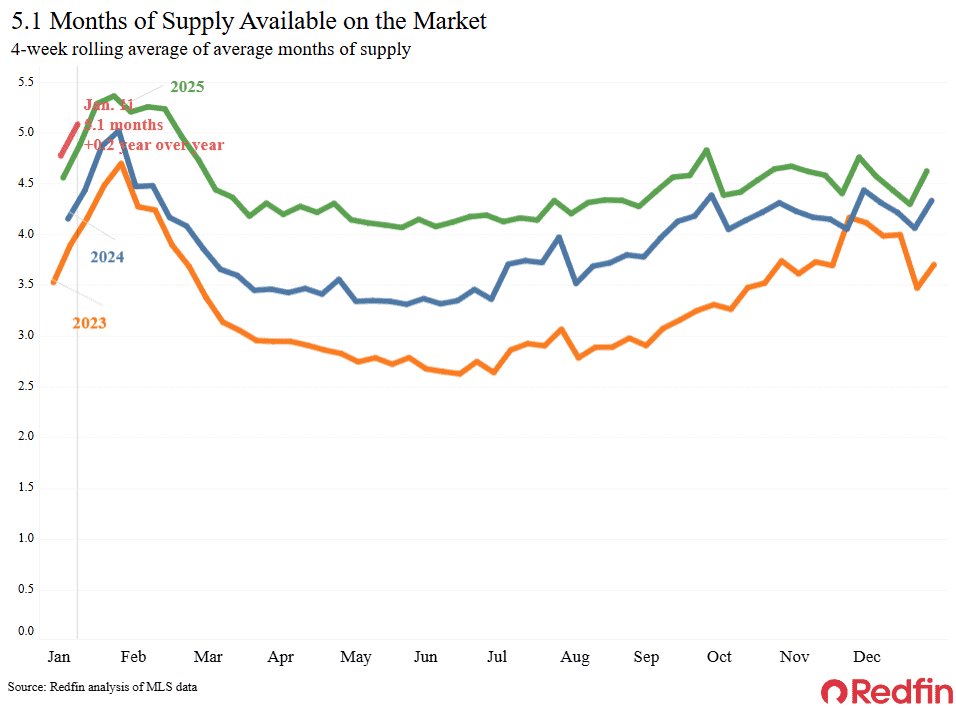

| Months of provide | 5.1 | +0.2 pts. | 4 to five months of supply is taken into account balanced, with a decrease quantity indicating vendor’s market situations |

| Share of houses off market in two weeks | 19.7% | Down from 21% | |

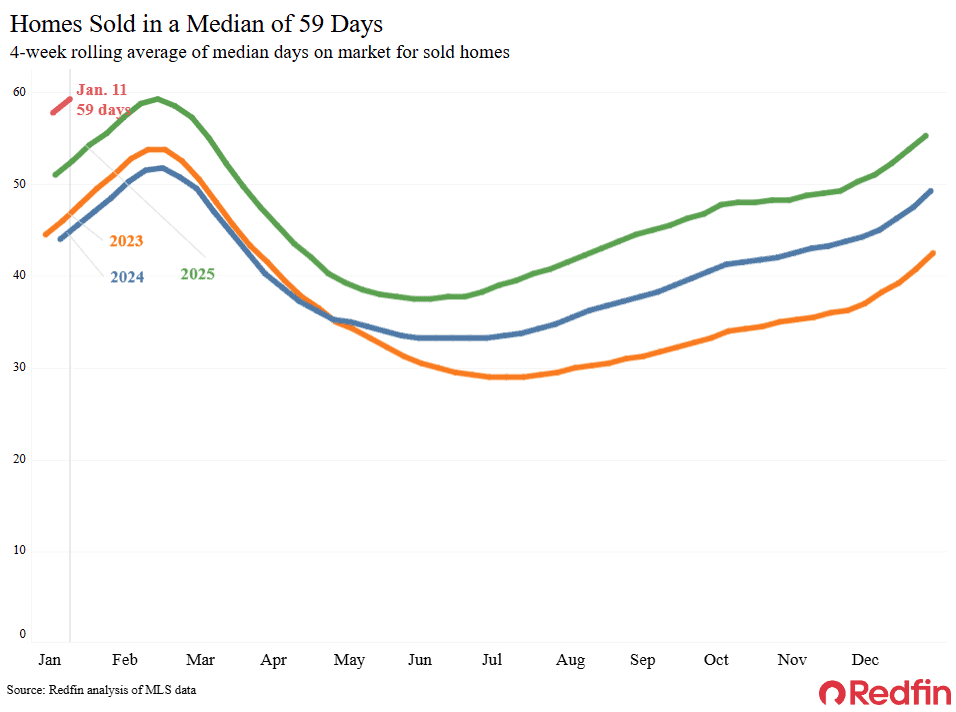

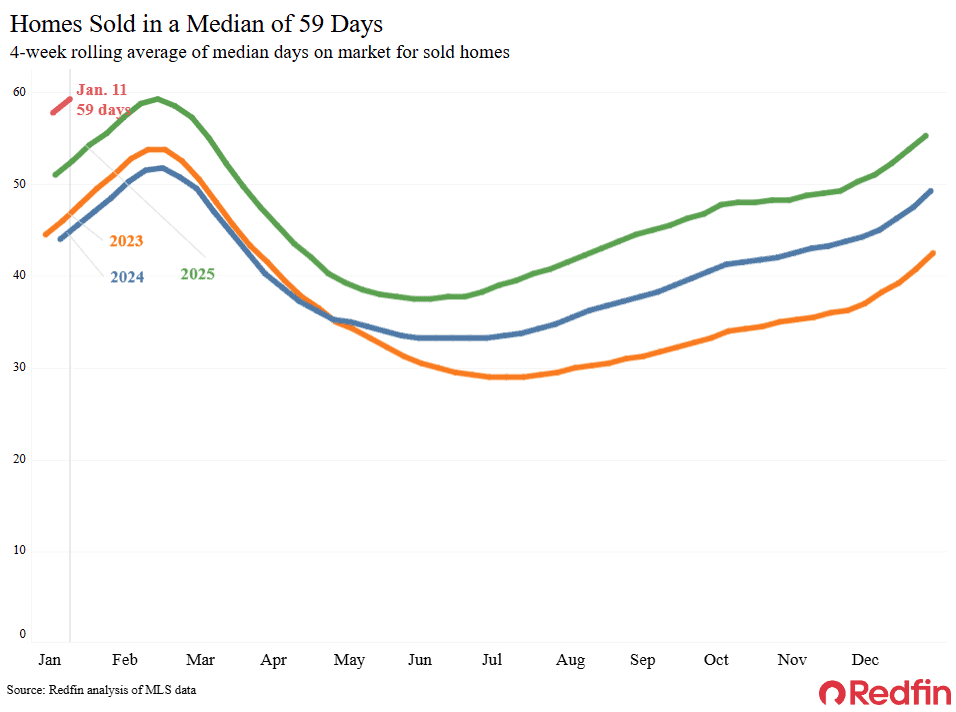

| Median days on market | 59 | +6 days | |

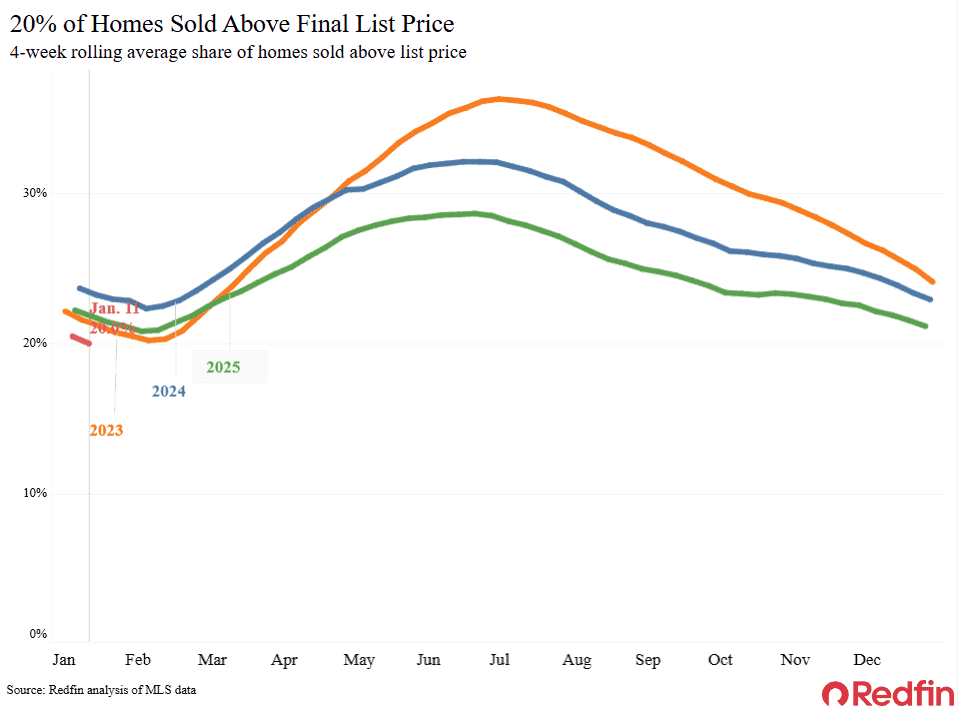

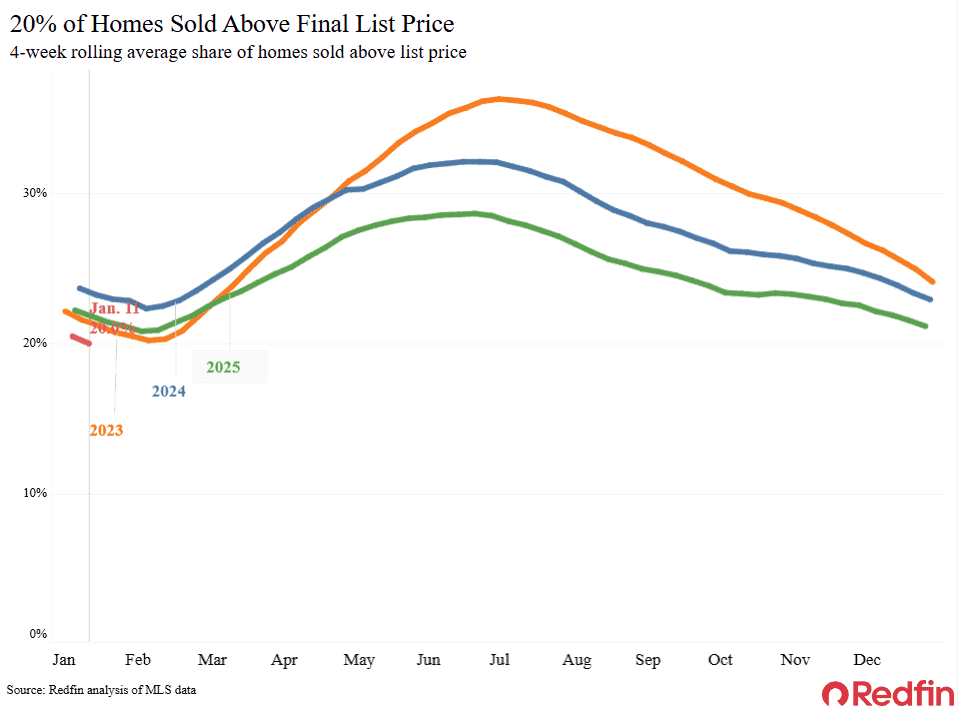

| Share of houses offered above record worth | 20% | Down from 22% | |

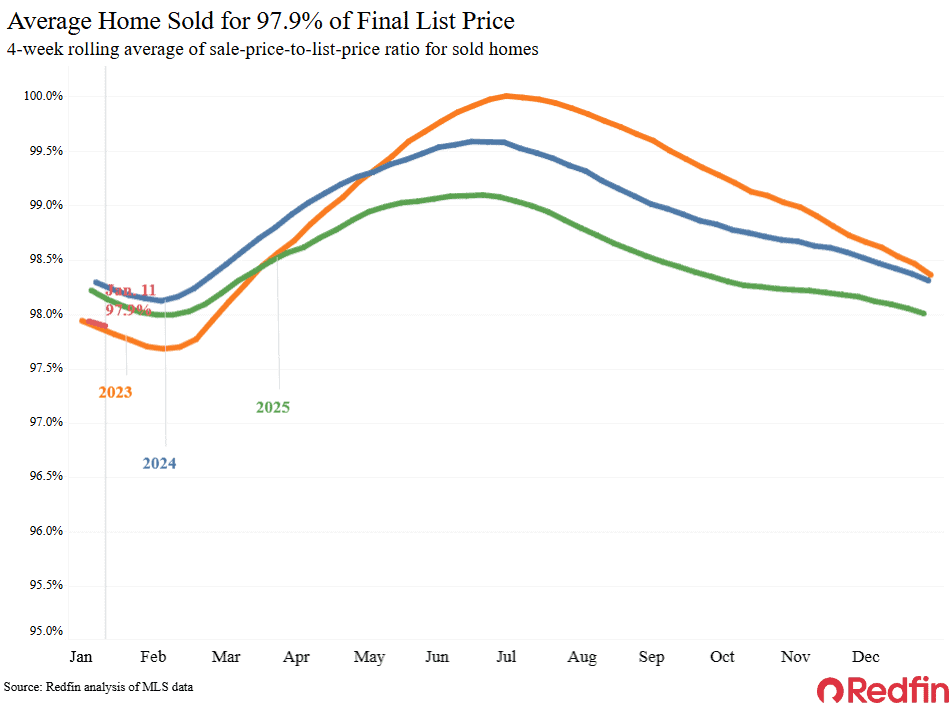

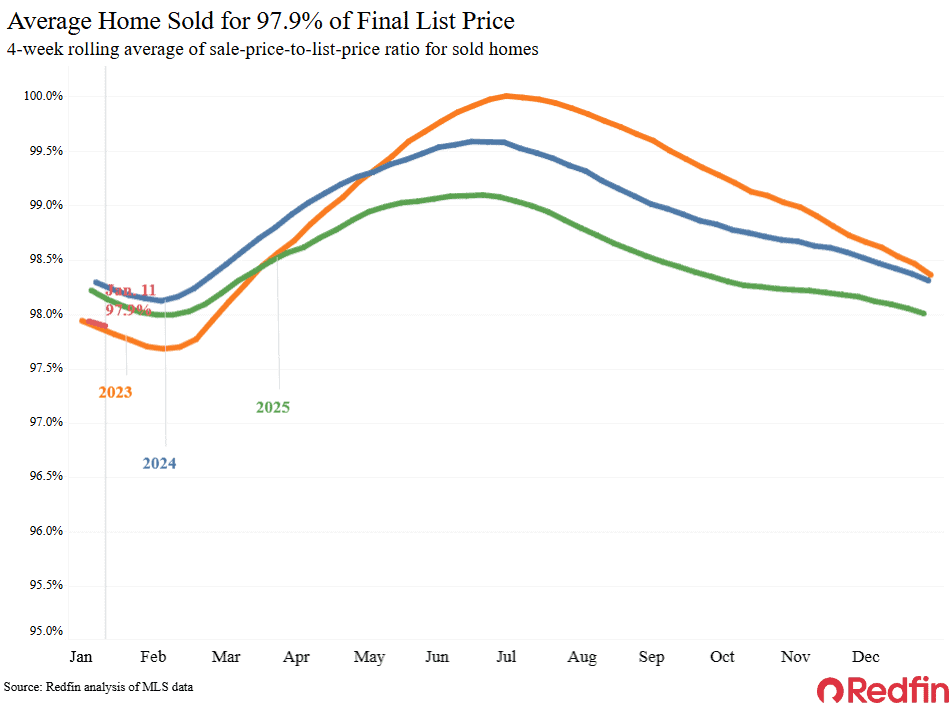

| Common sale-to-list worth ratio |

97.9% |

Down from 98.1% | |

|

Metro-level highlights: 4 weeks ending Jan. 11, 2025 Redfin’s metro-level information consists of the 50 most populous U.S. metros. Choose metros could also be excluded every now and then to make sure information accuracy. |

|||

|---|---|---|---|

| Metros with largest year-over-year will increase | Metros with largest year-over-year decreases |

Notes |

|

| Median sale worth | Cincinnati (8.4%)

Detroit (6.5%) Philadelphia (5.8%) Chicago (5.6%) Warren, MI (5.6%) |

Dallas (-4.4%)

San Jose, CA (-3.7%) Jacksonville, FL (-2.7%) Oakland, CA (-2.4%) Portland, OR (-1.8%) |

Declined in 15 metros |

| Pending gross sales | West Palm Seashore, FL (8.1%)

Fort Lauderdale, FL (5.2%) Columbus, OH (5.1%) Nashville, TN (4.9%) Phoenix (4.6%) |

San Jose, CA (-38.1%)

San Francisco (-24.6%) Warren, MI (-24%) Oakland, CA (-22.1%) Minneapolis (-21.1%) |

Elevated in 9 metros |

| New listings | Baltimore (12.6%)

Washington, D.C. (7.8%) Pittsburgh (6.6%) Milwaukee (5.8%) Fort Price, TX (5.1%) Phoenix (3.6%) Cleveland (1.6%) |

San Francisco (-26.7%)

Jacksonville, FL (-25.2%) Oakland, CA (-21.8%) Tampa, FL (-19.7%) Orlando, FL (-17.7%) |

Elevated in 7 metros |

Seek advice from our metrics definition page for explanations of all of the metrics used on this report.

Source link